If you’re aiming to secure your enterprise and boost credibility, establishing an LLC in Ohio is a smart move. It’s not as difficult as you might imagine, but you’ll need to follow a few specific steps to make it formal. From choosing the appropriate name to complying with legal requirements, each phase is essential. Before you file any paperwork, though, there’s one vital element you can’t afford to overlook…

Choosing a Name for Your Ohio LLC

A successful Ohio LLC commences with a strong name that meets state regulations. You’ll want to come up with ideas that reflect your enterprise's purpose and stand out from the competition.

Ohio law mandates your LLC name to feature “Limited Liability Company” or abbreviations like “LLC.” Steer clear of terms implying government association or controlled professions.

Ensure that your selected name isn’t already taken using Ohio’s corporate name search. Don’t neglect online branding—make sure a corresponding domain is obtainable.

Once you’ve identified an available name, you can reserve it for 180 days with the Secretary of State by submitting a reservation form.

Appointing a Statutory Agent

Every Ohio LLC requires a statutory agent, sometimes called a designated contact, to handle official documents on your business’s behalf.

You can select an person or a business entity with a street address in Ohio—P.O. boxes aren’t permitted. Your statutory agent must be present during regular business hours to accept service of process, tax documents, and official letters.

You can serve as your own agent, appoint someone you trust, or hire a professional service. Make sure your agent’s information is up-to-date, as failing to update a registered agent can endanger your LLC’s compliance status.

Filing Articles of Organization

Once you’ve appointed your statutory agent, you’re prepared to file the Articles of Organization with the Ohio Secretary of State.

Send Form 533A via the web, by mail, or personally. You'll need to give your LLC’s name, effective date, company objective, address, and statutory agent’s details.

Double-check everything for correctness, since errors can hinder approval. The state processing charge is $99. If you submit online, you’ll typically experience quicker processing.

After processing, check your email or mailbox for verification of approval. Once authorized, your LLC is legally recognized and can do business in Ohio under its official name.

Creating an Operating Agreement

Although Ohio legislation doesn’t require LLCs to have an operating agreement, creating one is encouraged to clarify how your enterprise will operate.

An operating agreement details each participant's rights, responsibilities, and share of profits. You’ll prevent disputes by defining how decisions will be made and what happens if someone leaves the company.

Even if you’re a sole-proprietor LLC, this agreement provides authenticity and can help protect your limited liability status.

Customize your agreement to your particular needs so everyone’s on the same page. Once you’ve finalized it, have all members look over and endorse before moving forward.

Meeting Ongoing Legal Requirements

To keep your Ohio LLC in compliance, you’ll need to adhere to a few important legal requirements.

First, periodically update your statutory agent’s information if anything modifies. Ohio read more doesn’t demand annual reports, but you’ll still need to process state and federal taxes each year.

If you receive sales tax or have workers, make sure you sign up with the Ohio Department of Taxation and retain the appropriate payroll taxes.

Also, update any necessary business permits on time.

Being compliant not only prevents fines but also ensures your LLC’s legal protection and active status with the state.

Conclusion

Establishing an LLC in Ohio is simple when you understand the steps. Start with a original name, choose a statutory agent, and file your Articles of Organization. While crafting an operating agreement isn’t compulsory, it’s wise to define how your enterprise will operate. Don’t forget to adhere to ongoing obligations like taxes and licenses. By implementing these steps, you’ll set up your Ohio LLC for regulated security, efficient functioning, and a firm foundation for growth.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Lynda Carter Then & Now!

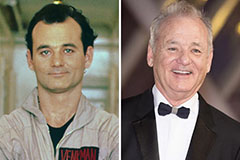

Lynda Carter Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!